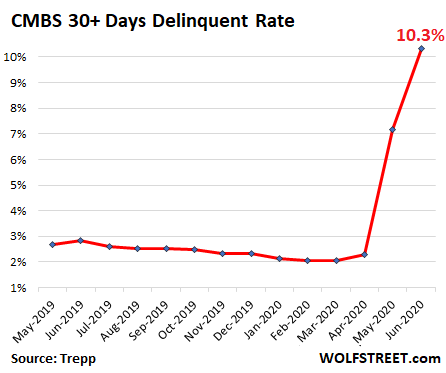

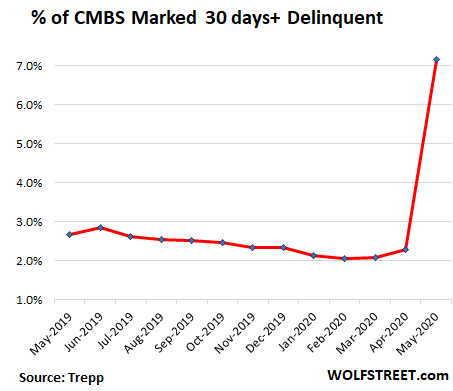

The overall default rate with mortgage backed securities overall has leapt from 1 46 in may to 3 59 in june the greatest one month increase since fitch started tracking these things 16 years ago which includes the period called the great recession when they collapsed.

Mortgage backed securities default rate.

Basis points selected by default if you select basis points prices are displayed in 0 01 increments.

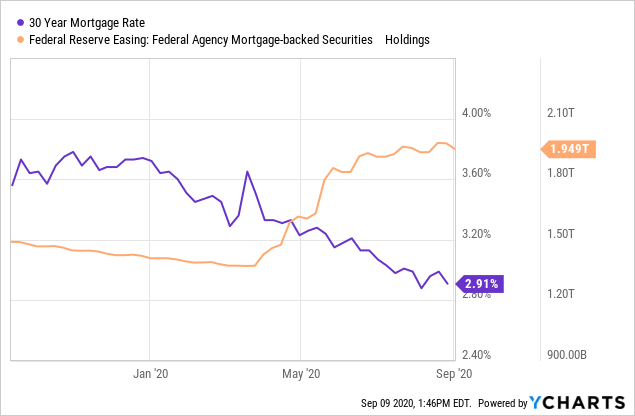

In turn their prices tend to decrease at an increasing rate when rates are rising.

The interest rate model for the economy.

Our mbs market data page allows you to select and display prices in two formats.

Prepaid principal usually variable depending on the actions of homeowners as governed by prevailing interest rates collateralized mortgage obligations cmos cmos are repackaged pass through mortgage backed securities with the cash flows directed in a prioritized order based on the structure of the bond.

Investors got hit hard as well as the value of the mortgage backed securities they were investing in tumbled.

This is known as negative convexity and is one reason why mbss offer higher yields than u s.

Figure 1 valuation of mortgage backed securities.

The constant default rate.

Excessive consumer housing debt was in turn caused by the mortgage backed security credit default swap and collateralized debt obligation sub sectors of the finance industry which were offering irrationally low interest rates and irrationally high levels of approval to subprime mortgage consumers due in part to faulty financial models.

This was made more difficult due to people still buying homes even as the bubble.

An annualized rate of default on a group of mortgages typically within a collateralized product such as a mortgage backed security mbs.

On the interest rate modeling side there are two primary families of models.

However mortgage backed securities prices tend to increase at a decreasing rate when bond rates are falling.

Below is a review of the three assumptions that have to be modeled for the mortgage backed securities valuation model.